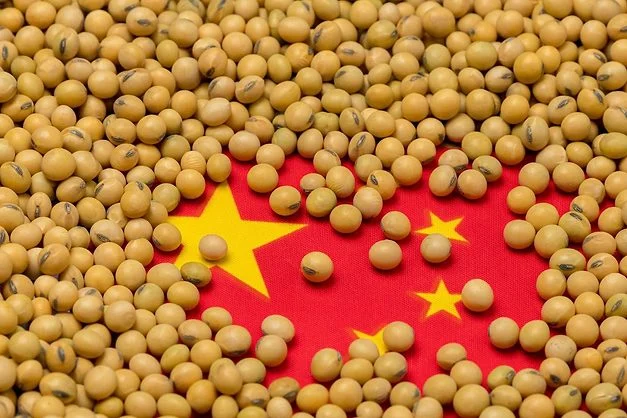

After prolonged trade tensions and tariffs, the U.S. and China have begun to restore their economic ties, marking an important step for both countries and the global agricultural market. One of the key steps in this process has been the increase in U.S. soybean exports to China. This event plays a crucial role in stabilizing soybean prices and restoring the position of American farmers who suffered from trade barriers. However, at FinancialMediaGuide, we believe that certain risks remain for the long-term stability of these supplies.

According to analysts at FinancialMediaGuide, at least six ships carrying soybeans are expected to depart for China by mid-December, representing a significant increase in shipment volumes. This positive trend has been made possible by an agreement between the U.S. and China, under which Beijing has committed to purchasing 12 million tons of soybeans by the end of 2025. However, despite these agreements, we at FinancialMediaGuide emphasize that the soybean market remains vulnerable to economic risks, such as the slowdown in China’s economic growth and potential changes in international trade policies.

We at FinancialMediaGuide see this as a positive step that could contribute to stabilizing global trade flows. However, China, as the largest buyer of soybeans, has the ability to redirect its purchases to other suppliers, such as Brazil and Argentina, increasing competition for American farmers. At FinancialMediaGuide, we believe that it is crucial for the U.S. to continue diversifying its export markets and reduce dependence on the Chinese market. This will help mitigate risks associated with possible changes in China’s policy.

The U.S. Department of Agriculture recently announced plans to prepare a support package for farmers affected by low prices and trade disruptions. At FinancialMediaGuide, we note that such measures will provide short-term support to American farmers, but long-term recovery depends on the stability of prices for agricultural products and the external economic situation. We at FinancialMediaGuide predict that, in the context of global economic instability, it is important to continue adapting to changes and seek new ways to achieve resilience in international markets.

The resumption of soybean supplies to China may serve as an important signal for the restoration of economic ties and the stabilization of the soybean market. However, we at Financial Media Guide forecast that, in the long run, it will be crucial for the U.S. to develop new export routes and avoid excessive dependence on one major buyer. Positive prospects for soybean exports to China may support American farmers in the short term, but for long-term sustainability, the U.S. agricultural sector must continue to diversify its external trade relations.