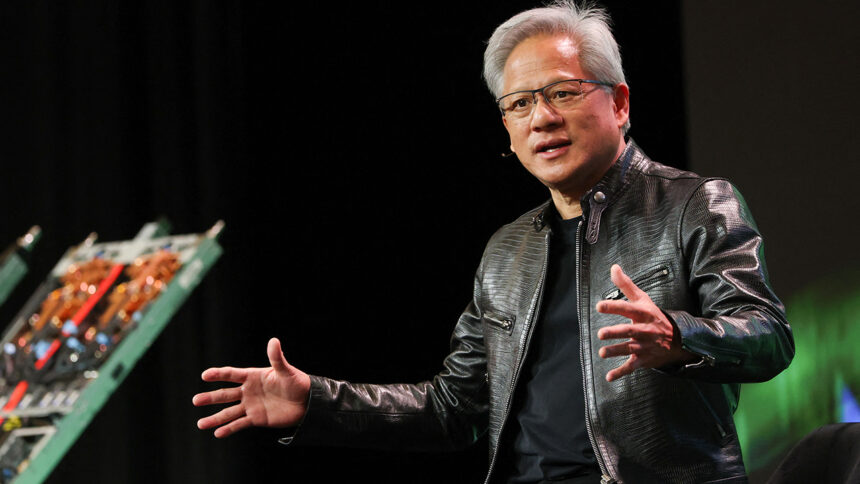

Nvidia CEO Jensen Huang said the rapid expansion of artificial intelligence is setting off what he described as the “largest infrastructure buildout in human history,” as companies and governments pour trillions of dollars into the computing power needed to run AI systems in real time.

Speaking with FOX Business’ Maria Bartiromo from the World Economic Forum in Davos, Huang said the buildout will span data centers, chip factories and so-called “AI factories,” adding that the shift is still in its early stages.

“We are seeing just incredible demand. And what’s going on around the world is that AI, as you know, is a layer cake. It starts at energy, then chips – the layer that we’re at – infrastructure, cloud infrastructure, land power… building data centers,” Huang said on Wednesday.

“President [Donald] Trump wants to re-industrialize the United States. And AI is really a perfect time to do it,” he added. “The thing that’s really important to recognize is that this is the largest infrastructure buildout in human history. It’s really unbelievable. It’s a perfect time for the United States to jump on this because it allows us to bring jobs home… Workers, plumbers, electricians, network technicians, construction workers, designers, architects. It’s going to create lots and lots of jobs.”

LUTNICK SAYS GREENLAND IS KEY TO U.S. NATIONAL SECURITY AS ARCTIC TRADE ROUTES OPEN

Nvidia has cemented itself as a leading artificial intelligence hardware provider, becoming the first publicly traded company to reach a $5 trillion market valuation, driven by the global AI boom.

“If you just think about the world’s ecosystem [of] industries, $100 trillion out of that, probably something like $20-somewhat trillion is R&D spend or [operating expenses] spend. A lot of that is going to be augmented with artificial intelligence,” Huang said.

“Over the course of the next 15 years, a lot of estimates come in at $85 trillion,” he noted. “And so we’re going to build a lot of infrastructure.”

Despite the trillions of dollars being spent on expanding AI, Nvidia’s CEO said its newer H200 chips are more efficient and affordable.

“Every single year, we’re driving up energy efficiency, and we’re driving down the token cost. This way, AI can continue to be affordable, more clever, more smart, while being more affordable for everybody to use,” Huang said.

More recently, the Trump administration formally green-lit Nvidia exports, allowing the tech giant to ship its artificial intelligence chips to China and other countries. Huang dismissed concerns about trade with China, saying their military is not dependent on U.S. hardware.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“H200 [chips are] not used by their military because their military, like our military, builds on [their] own chips, and they build plenty of great chips. Huawei and many new startups, they’ve all gone public this year, hundreds of billions of dollars of market value now in building AI chips. So they have lots of AI chips for themselves,” he said.

“President Trump wants us to go win the marketplace, compete around the world, bring home jobs, create revenue for the United States,” Huang said, “and continue to lead the technology around the world. We can’t concede any market.”

FOX Business’ Michael Sinkewicz contributed to this report.