FinancialMediaGuide notes that the 2026 Winter Olympics in Italy promise not only athletic achievements but also to become a significant milestone in assessing the financial value of Olympic medals. Amid the rapid rise in precious metal prices, the medals awarded to winners will be the most expensive in Olympic history. This trend of increasing medal costs requires not only a reassessment of their material value but also an understanding of how the rising prices of gold and silver are shaping a new financial landscape for such awards.

The rise in the prices of gold and silver in recent years has become a key factor affecting the cost of Olympic medals. According to expert data, since the Paris 2024 Olympics, gold and silver prices have increased by 107% and 200%, respectively. These changes mean that a gold medal to be awarded to the 2026 Winter Games champions will now cost around $2,300 – more than double the price of the 2024 medal. A silver medal will cost nearly $1,400, three times higher than the price set at the previous Olympics. We at FinancialMediaGuide see this as a reflection of global economic trends, such as the rising demand for precious metals as safe-haven assets amid political risks and economic instability.

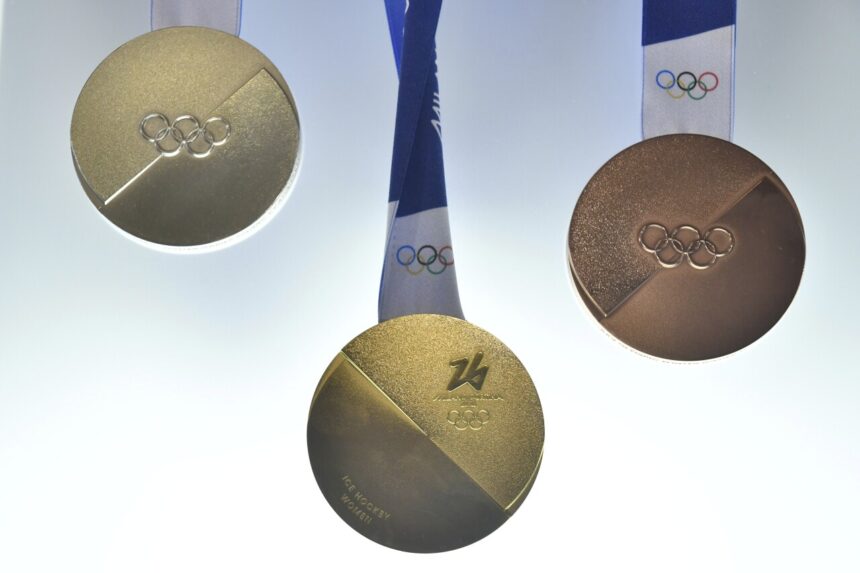

However, as recent data shows, despite the significant rise in the medals’ prices, their composition has remained unchanged. The gold medal, which weighs 506 grams, contains only 6 grams of pure gold, with the rest being silver. This is due to the use of recycled materials for manufacturing the medals, which lowers their actual value but does not negate their increasing worth in light of rising metal prices. Bronze medals, made from copper, are worth about $5.60, but the material and its cost play a far lesser role in the context of the overall rising metal prices.

We at FinancialMediaGuide emphasize that with the rise in gold and silver prices, the market for collecting Olympic medals is also changing. These awards are starting to be seen not just as sports symbols but as valuable investment assets. History confirms this trend: in 2015, a gold medal from the 1912 Olympic Games was sold at auction for $26,000, despite its original value being much lower. In our opinion, this is a clear example of how Olympic medals evolve from being mere mementos to valuable artifacts capable of attracting the attention of collectors and investors.

However, despite the rise in prices and increased interest from collectors, most Olympians are not looking to sell their medals. For athletes, the medals remain not just objects of value but important symbols of their achievements. Yet, as metal prices rise and investor interest grows, we can expect the number of those willing to sell their medals to increase. Given global economic instability and growing interest in gold and silver, such medals could become important assets for investors looking to diversify their portfolios.

At FinancialMediaGuide, we predict that the value of Olympic medals will continue to rise in the future, with each new generation of athletes participating in the Games. The 2028 Olympic medals are likely to be even more expensive than the 2026 awards, driven not only by rising metal prices but also by ongoing global economic instability and increasing demand for gold and silver as traditional safe-haven assets.

In conclusion, it can be confidently said that the Olympic medals of 2026 will not only be significant awards for athletes but also valuable assets for collectors and investors. In financial terms, Olympic medals are becoming objects of interest for many, further emphasizing their growing value amid the instability of global markets. We at Financial Media Guide believe that the trend of increasing medal prices will continue in the coming years, and Olympic awards will remain an important element of the global economic system where sports, culture, and economics intersect.