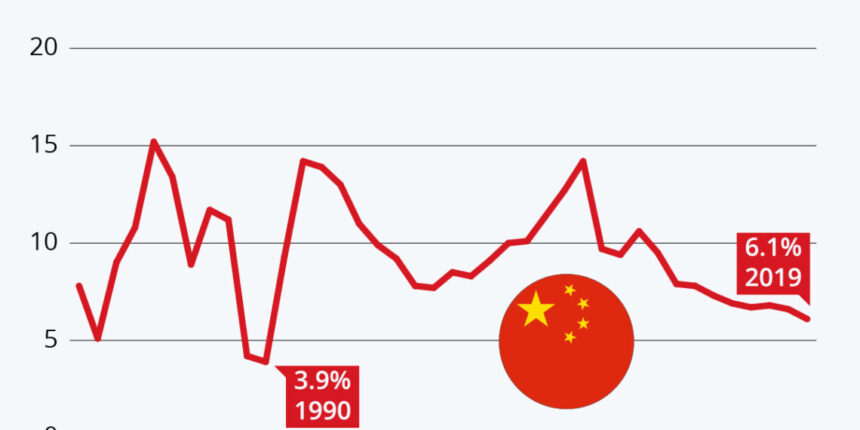

At FinancialMediaGuide, we note that China’s economy is showing clear signs of slowing, confirming that its heavy reliance on exports and manufacturing has become a major risk to long-term stability. According to data from the National Bureau of Statistics, GDP grew 4.8% in the third quarter, in line with forecasts but marking the weakest pace of growth in the past 12 months.

Our analysts at FinancialMediaGuide emphasize that China’s economy is increasingly dependent on industrial production and exports, while domestic demand remains fragile. This imbalance continues to worry both investors and policymakers, especially as trade tensions with Washington expose the vulnerabilities of China’s export-driven growth model.

Although the overall growth matched expectations, consumer confidence remains weak, with retail sales falling to a 10-month low. Meanwhile, China’s exports to the U.S. fell 27% year-on-year, while shipments to the European Union, Southeast Asia, and Africa rose by 14%, 15.6%, and 56.4%, respectively.

At FinancialMediaGuide, we observe that Beijing may be using the resilience of its headline growth figures as a show of economic strength in upcoming diplomatic engagements – including Vice Premier He Lifeng’s meeting with U.S. Treasury Secretary Scott Bessent in Malaysia and the potential Trump-Xi summit in South Korea.

However, despite short-term export diversification gains, profitability pressures and intense price competition are eroding margins. Many manufacturers are prioritizing volume over returns as they pivot toward new markets beyond the U.S.

The property sector crisis remains another drag on the economy, with real estate investment down 13.9% in the first nine months of the year, further undermining consumer confidence. While the government has introduced modest stimulus measures, our analysts believe that policy focus is shifting toward long-term reforms – such as pension restructuring – which could support consumption in the future but limit it in the short term.

At the same time, industrial output rose 6.5% in September, beating expectations, while fixed-asset investment contracted for the first time since the pandemic. This indicates that manufacturing remains the main growth driver, yet its potential is constrained without stronger domestic demand.

At Financial Media Guide, we view the upcoming 15th Five-Year Plan meeting as a key test for China’s long-term economic strategy. A renewed focus on high-tech manufacturing could strengthen the country’s global competitiveness, but without deeper structural reforms to boost domestic demand, sustained growth will remain uncertain.

Previously, we reported on how Stellantis accelerates restructuring – Filosa forms a new leadership team to relaunch the automotive giant.